An Introduction to China Work Permit Point Scoring System

China’s new work permit system for foreigners was rolled out nationwide on April 1, 2017. Under the new framework, the previous Alien Employment Permit and the Foreign Expert Permit have been combined into a single work permit, issued to any foreigner eligible to take up work in China.

The changes to the system result in a more streamlined process, doing away with inconsistent regional administration, and allows for employers to submit applications online. Furthermore, the change has removed any confusion foreigners may have had as to which permit to apply for.

The new system has also introduced a three-tier talent grading system for expatriates, the benefits of which are less clear. While A-grade expats enjoy some additional advantages, those falling in Tier B and Tier C may face tougher entry requirements, lower permit validity, and longer waiting times than before.

This article clarifies who is placed where under the new system, and the implications of the classifications. Expats are placed in either Tier A, B, or C by earning the associated amount of points under the point scoring system, or by fulfilling a condition that automatically places them in a given tier.

Point scoring system introduced

The new work permit system introduces a point scoring system to judge candidates’ qualifications. Applicants scoring 85 or more points qualify for Tier A; those scoring 60-85 class as Tier B; and those scoring below 60 fall under Tier C.

China Work Permit Point Scoring System | ||

Item | Criteria | Score |

Qualification exclusive of point base system | Qualifies for a plan for the introduction of talent and holds internationally recognized achievement in specialized areas | - |

Conforms to criteria for encouraged employment categories | - | |

Innovative entrepreneurial talent and young talent | - | |

Annual salary paid by employer | RMB 450K and abov e | 20 |

RMB 350K-450K | 17 | |

RMB 250K-350K | 14 | |

RMB 150K-250K | 11 | |

RMB 70K-150K | 8 | |

RMB 50K-70K | 5 | |

Under RMB 50K | 0 | |

Educational qualifications or vocational skills qualifications | Doctorate; highest possible international vocational qualification; technical expert or equivalent | 20 |

Master’s; technical expert or equivalen t | 15 | |

Bachelor’s; high level worker or equivalent | 10 | |

None | 0 | |

Work experience | Over 2 years: for each additional year add 1 point (maximum 20) | 6-20 |

2 years | 5 | |

Under 2 years | 0 | |

Time spent working in China per year (in months) | Over 9 | 15 |

6-9 | 10 | |

3-6 | 5 | |

Under 3 | 0 | |

Mandarin proficiency | Former Chinese National | 5 |

Bachelor’s degree or above, taught in Chinese | 5 | |

HSK (Chinese Proficiency Test) level 5 or above | 5 | |

HSK level 4 | 4 | |

HSK level 3 | 3 | |

HSK level 2 | 2 | |

HSK level 1 | 1 | |

Does not speak any Mandarin | 0 | |

Location of employment (in China) | Western regions | 10 |

Old industrial areas in the Northeast region | 10 | |

Areas of interest such as impoverished counties | 10 | |

Age | 18-25 | 10 |

26-45 | 15 | |

46-55 | 10 | |

56-60 | 5 | |

Over 60 | 0 | |

Extra credit (expertise) | Has graduated from a high-level university | 5 |

Has work experience at a Fortune 500 | 5 | |

Possesses patent or intellectual property rights | 5 | |

Already has 5+ years of work experience in China | 5 | |

Extra credit (given at regional level according to encouraged areas of employment) | Talent satisfying shor tages in areas necessary for the development of the regional economy (concrete criteria are specified by the provincial department responsible for the management of foreigners) | (0~10) |

How your tier affects your work status

Tier A comprises approximately 16 percent of expats in China. Individuals in this category enjoy several benefits not enjoyed by Tier B and Tier C workers, including a “green channel” service. This allows for expedited approval, resulting in processing times shortened by around five working days.

Tier A expats also benefit from paperless verification during the application process. Moreover, they are not subject to requirements of age, education degree, or work experience. In general, individuals qualifying for Tier A enjoy a more inclusive and convenient environment, both before and after the application process.

Around 61 percent of expats fall into the Tier B. A bachelor’s degree and two years of work experience in a relevant field should be enough to qualify for Tier B status in most cases, so long as the position is reasonably elevated or technical. However, application procedures are strict and time consuming in comparison to Tier A. Those falling under Tier B must provide all relevant documents in original paper form.

Tier C (approximately 22 percent of expats) is meant for individuals not planning to work in China for extended periods of time, such as company representatives placed abroad for a few months. It also accommodates individuals entering the country under Chinese government young talent initiatives (currently only the China-France 1,000 interns program exists).

Tier C applicants can expect permit availability subject to the needs of the labor market and are subject to government quotas, longer processing times, and short validity periods.

Weighing the implications

Most individuals already employed in China with a work permit have no reason to worry. Most of those who qualified under the old system will attain at least Tier B status once applying for a new permit.

For new applicants, most mid-level to senior managers or technical staff should be clear to receive Tier B status or above. Any individual with experience and qualifications in science, technology, engineering, and mathematics (STEM) fields will also likely face no difficulty in this respect.

Lack of Mandarin proficiency is of little worry, as this has a negligible effect on tier placement.

Additionally, individuals hoping to work in Central or Western China, or businesses hoping to hire foreigners there, are likely to succeed, due to a governmental drive to develop those regions.

Those in mid-level to senior positions in higher education are also treated favorably by the new tier system. Businesses hoping to employ fresh university graduates into entry-level positions may find themselves frustrated.

Opportunities to get around the two year s requirement have opened up in some cases, such as inside free trade zones. However, the average graduate with a bachelor’s degree will find it hard to work in China without first acquiring at least two years of industry experience abroad.

China Individual Income Tax for Foreigners as of 2019

On 31 August 2018, the China’s National People’s Congress (NPC) passed the Draft Amendment to the People’s Republic of China (PRC) IIT Law, with the amendments becoming effective from 1 January 2019.

Apart from the loosened administration measures on the tax deductible costs and expenses for corporate income tax, significantly reduced effective tax rates for value added tax, the renewed individual income tax law (hereinafter referred to as “New IIT Law”) has also provided a big relief on the tax burden of personal income, to make sure each individual can benefit from the tax reduction policy to a certain extent.

I. Introduces the definition of “resident” and “non-resident” for tax purposes

Taxpayer status | Definition | Taxable income |

Resident taxpayers | China-domiciled individuals Non-China-domiciled individuals who stay in China for 183 days or more in a calendar year | Both China sourced and non-China sourced income are subject to IIT |

Non-resident taxpayers | Non-China-domiciled individuals Non-China-domiciled individuals who stay in China for less than 183 days in a calendar year | Only China sourced income is subject to IIT |

II. “ Five-year rule” upgraded to “ Six-year rule”

As a special relief for resident taxpayers who are not domiciled in China, the New IIT Law upgraded the former Five-year-rule to the current Six-year-rule on their worldwide income tax payment obligation in China, which is, for a resident taxpayer who is not domiciled in China, his/her personal income derived from outside China which is not paid or borne by a Chinese individual or entity can be exempted from China IIT, unless the individual has resided in China for no less than six calendar years before, in each of which he/she resided in China for 183 days accumulatively or more and without leaving China for more than 30 days in a single trip.

III. Higher standard deduction threshold

Amendments to the Individual Income Tax Law of the People’s Republic of China were passed on 31 August 2018 and new tax calculation methods came into effect on 1 October, 2018, the standard deduction applicable to ‘taxable income’ in China has increased from a monthly RMB 3,500 for resident taxpayers (and RMB 4,800 for non-residents) to RMB 5,000.

IV. Tax calculation for resident taxpayers

The following progressive tax rate brackets are applied on the annual comprehensive income of a resident taxpayer, which includes wages and salaries, labor remuneration, author remuneration and royalties. Annual taxable income is annual income after standard deduction of RMB 60,000, employee's portion of China social security contribution and special additional deductions.

Annual taxable income = Annual income - Annual standard deduction - Cumulative itemized deductions expenses / tax-free fringe benefits - Other cumulative deductions

Tax payable = Annual taxable income × applicable tax rate - Quick deduction

Individual Income Tax Rates and Deductions in China (Table I) The tax rates are applicable to wages and salaries, labor remuneration for resident taxpayer

|

About foreign individuals tax-free fringe benefits:

F rom January 1st 2019 to December 31st 2021 , For resident taxpayers who are foreign expatriates living in China, they can choose to enjoy either deduction for additional itemized deductions, or continue to enjoy tax-free fringe benefits such as housing benefit, language training, child education expense with no double benefits claim. And they cannot switch within the same tax year once elected.

From 2022,01.01, Foreign individuals will no longer enjoy above tax-free fringe benefits. They should enjoy itemized deductions.

V. Tax calculation for non-resident taxpayers

The IIT for non-resident taxpayers are still calculated on a monthly basis applying the following monthly progressive tax rates.

Monthly taxable income = Monthly income - RMB 5000 (Standard deduction)

Tax payable = Monthly taxable income × Applicable tax rate - Quick deduction

Individual Income Tax Rates and Deductions in China (Table II) The tax rates are applicable to wages and salaries, labor remuneration, author remuneration for non-resident

|

VI. Tax calculation on annual bonus

- Annual bonus for resident taxpayers: the preferential tax treatment on annual bonuses remains unchanged until 31 December 2021, meaning that each resident taxpayer can choose whether to include their annual bonus in their comprehensive income or have it taxed separately.

- The bonus can be taxed separated from the annual income and be divided by 12 to determine the applicable monthly tax rate (according to Table 2), which may lower the effective tax rate to a certain extent.

- Tax payable = Annual Bonus × Applicable tax rate - Quick deduction

- Starting from 1 January 2022, annual bonus compensation must be included in comprehensive income for IIT calculation.

Individual Income Tax Rates and Deductions in China (Table II) The tax rates are applicable to wages and salaries, labor remuneration, author remuneration for non-resident

|

Guide to Transferring, Changing, Extension Work Permit for Foreigners in China

For foreigners working in China, the work permit is a crucial document that must be attained prior to commencing work. The work permit is tied to your employer, which means that when changing jobs, the work permit must also be transferred to the new employer.

I. If the foreigner changes a new employer but still the same occupation and his/her residence permit is valid, he/she can stay in China during the application process and will not need to apply for a new Visa Z.

Transfer your work permit in two steps

Step 1: Cancel the current work permit

A former employer should apply for cancellation of a work permit within 10 working days from when an employment relationship ceases.

Documents R equired:

- Application Form for Cancellation of the Foreigner’s Work Permit: Fill in the online application - print it out - send to the applicant for signing – stamp it with the employer’s seal - upload it to the system.

- Credentials for the dissolution of employment and termination of contract or other causes related to cancellation: In the event of dissolution of employment and termination of contract, the signatures of both the employer and the applicant are required; if the applicant resigns arbitrarily and the employer cannot contact with the applicant, the employer shall submit a description of cancellation.

Step 2 : Apply for a new work permit

Foreigners require to apply for new work permit within 30 days after the cancellation of the previous work permit.

Documents Required:

- Application Form for C hange of the Foreigner’s Work Permit

- Employment contract

- V alid Resident Permit and Passport

- C ertificate of cancellation

Foreigners cannot provide these document s , such as A cademic c ertificate , Certificate of no criminal record , Certificate of physical examination , etc.

II. If the foreigner changes a new employer and new occupation or his/her residence permit is expired, he/she shall re-apply the Work Permit for Foreigners .

III. Extension of the Work Permit for Foreigners

If the employer continues to employ the applicant at the same position (occupation), it shall submit the application to the decision-making authority 30 days or more before the expiration date of the applicant’s work permit.

Documents Required:

- Application Form for Extension of Foreigner’s Work Permit

- Employment contract

- valid Resident Permit and Passport

- Work Permit for Foreigners

IV. Change of the Work Permit for Foreigners

In the event of change in the applicant’s personal information (such as name, passport number, title, and category) or other information, an application shall be submitted within ten working days from the date of the confirmation of change.

- Application Form for Change of Foreigner’s Work Permit

- A letter of change application (specifying the reason of change, the new title, etc., and stamped by the employer) and relevant credentials;

The Guide for Foreigners to Obtaining Work Permit and Visa in China

From April 1, 2017 , the work permit system of foreigners in China shall be implemented in a unified manner across the country. The Notice for the Work Permit for Foreigners and the Work Permit for Foreigners shall be issued. Foreigners working in China will undergo the relevant formalities of visa and residence upon the strength of the Notice for the Work Permit for Foreigners and the Work Permit for Foreigners.

This article is a comprehensive gui de to introduc ing th e whole process, shape the documents required for foreigners how to apply for the Work Permit and the relev ant formalities of visa and residence .

Overview:

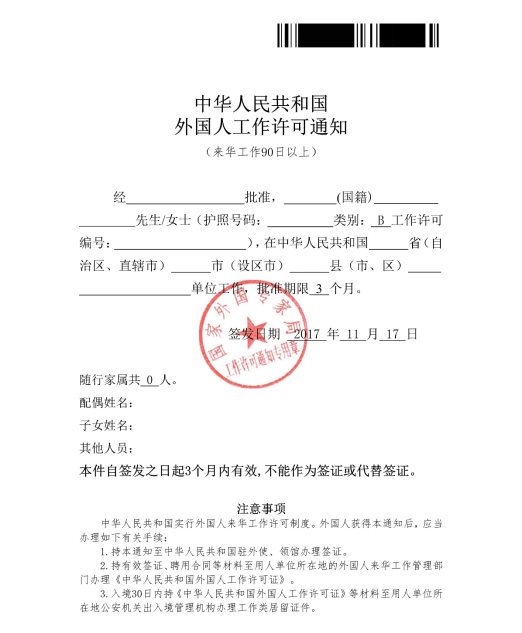

Step 1 :Application for the Notification Letter of Foreigner’s Work Permit before Entering China

Step 2 : Application for the Work Visa (Z Visa)

Step 3: Reg istration of Temporary Residence

Step 4: Application for the Work Permit for Foreigners after Entering China

Step 5: Appl ication for the Residence Permit

I. Application for the Notification Letter of Foreigner’s Work Permit before Entering China

Reception Authority: Foreign Experts Affairs

Approval Period : 15 working days

The employer directly ac c ess es to the Service System for Foreigners Working in China to register and submit the application : http://fwp.safea.gov.cn/

Documents Required:

- Application Form for Foreigner’s Work Permit: Before entering China, fill in the online application and print it out.

- Work Qualification Certificate: The previous employer of the applicant shall issue a work experience certificate related to his/her current position, covering the information about the position, work duration, and the projects that have been completed.

- The highest degree (academic qualification) certificate and certification documents or relevant approval documents and professional qualification certificates.

- Certificate of no criminal record and certification documents.

- Certificate of physical examination: A certificate of verification on physical examination record for foreigners or a certificate of health examination issued within six months by China’s inspection and quarantine authority shall be provided.

- Employment contract or employment certificate: The submitted contract shall be in Chinese, signed by the applicant and stamped by the employer.

- Passport or international travel certificate with no less than six months validity.

- Applicant’s bareheaded and full-face photo taken no more than six months ago.

- Accompanying family members’ credentials: Accompanying family members include spouse, children below 18, parents, and parents-in-law.

Sample:

II. Application for the Work Visa (Z Visa)

Reception Authority: Chinese Embassy

Approval Period: 7 working days

Documents Required:

- Actual passport

- Completed visa application form and one recent passport-size photo

- The Notification Letter of Foreigner’s Work Permit

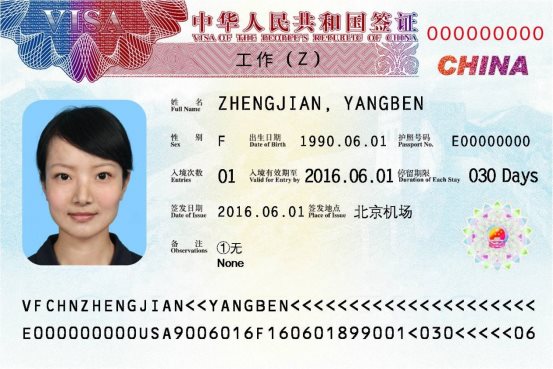

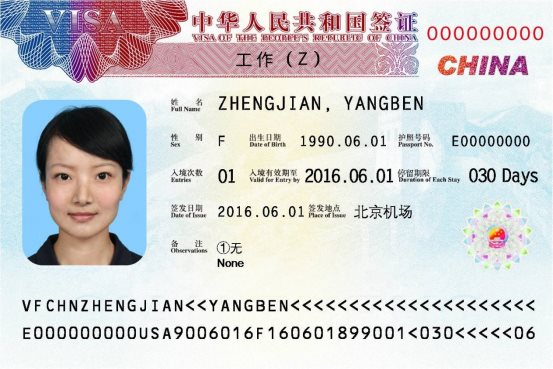

Sample: The new vision of 2019.06.1

III. Registration of Temporary Residence

Reception Authority: Local police station

Approval Period : Immediately

Foreign nationals in China require register their temporary residence with the public security bureau (PSB) within 24 hours after the foreigners ’ arrival at that dwelling place .

IV. Application for the Work Permit for Foreigners after Entering China

The foreigner shall apply for the Work Permit within 15 days after Entering China.

Reception Authority: Foreign Experts Affairs

Approval Period : 15 working days

Documents Required :

- Application Form for Foreigner’s Work Permit.

- Applicant’s certificate of physical examination

- Applicant’s valid visa or residence permit: Visa page, latest entry signature page, or the information page of the residence permit of the passport (or of the international travel certificate).

- Other documents: Documents provided as required by the reception authority or the decision-making authority.

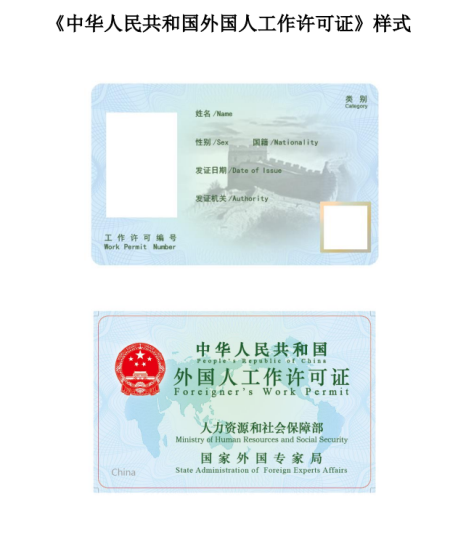

Sample:

V. Application for the Residence Permit (Work)

The foreigner shall apply for the Residence Permit within 30 days after Entering China .

Reception authority: The Exit-Entry Administration Department of Public Security Bureau

Approval Period : 7 working days

Documents Required:

- Original Passport

- Providing effective Receipt for Digital Photo Collection in Visa for Foreigners with the applicant’s signature.

- Copy of the 《 Registration of Temporary Residence for Visitors 》

- Accompanying family members’ credentials: the information page of the passport (or of the international travel certificate), certificate of family relationship

- Applicant’s photo (2 - inch photo with blue background)

- P hysical examination

- Foreigner’s Work Permit

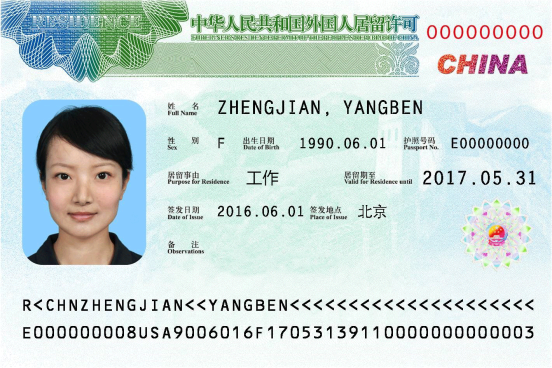

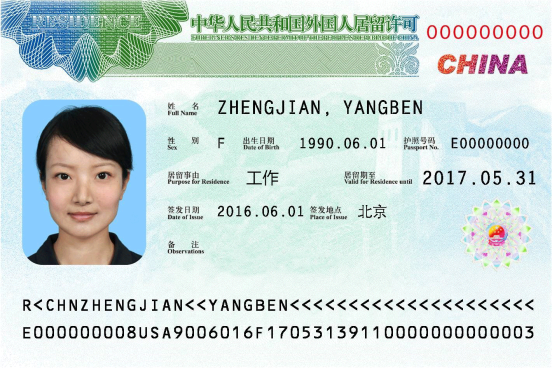

Sample: The new vision of 2019.06.01

外籍人才来华工作签证全流程 梳理

2017年4 月 1日起,我国在全国范围内实施外国人来华工作许可制度。按照《外国人在中国就业管理规定》,如外国人未在中国(仅指中国大陆,下文亦同)取得定居权或未取得中国国籍,则在中国境内工作、获取劳动报酬必须取得外国人来华工作许可(Foreigner's Work Permit,在外国人就业证和外国专家证两证合一政策施行前称之为就业证)。

除此之外,外国人在获得外国人来华工作许可后尚需向主管出入境管理部门申请获得合法居留许可,以在境内合法居留、工作。

本文就外籍人才申请办理工作许可,居留许可整理如下材料 。

流程概述:

Step 1 : 外国人工作许可通知 ( NOTIFICATION LETTER OF FOREIGNER ’ S WORK PERMIT )

Step 2 : 申请工作签证 ( Z Visa )

Step 3 : 办理住宿临时登记 ( Registration of Temporary Residence )

Step 4 : 申 请 外国人工作许可 ( Work Permit)

Step 5 : 申请 外国 人居留许可 ( Residence Permit)

下面就每个流程详细介绍该流程所受理的政府机构、所需时长、准备的材料及拿到的证件样例。

一、 申请《中华人民共和国外国人工作许可通知》(简称《外国人工作许可通知》) ( NOTIFICATION LETTER OF FOREIGNER ’ S WORK PERMIT )

受理 机构 :外国专家局

时长: 1 5 个工作日 ,可预留2 0 个工作日

用人单位 需在“外国人来华共工作管理服务系统”在 线注册账号 ,提交申请 。

材料:

1) 外国人来华工作许可申请表:入境前在线填写打印

2) 外国人才认定材料:应根据外国人来华工作分类标准(试行),提供符合认定条件的相关证明材料 . 通过计点积分达到外国高端人才( A 类)或外国专业人才( B 类)标准的,应提供相应的最高学位(学历)证书、职业资格证明、汉语水平能力(中国汉语水平考试 HSK 证书等)、来华工作年薪的收入证明、工作资历证明材料以及计点积分表等材料。

3) 工作资历证明:由申请人原工作过的单位出具从事与现聘用岗位工作相关的工作经历证明。

4) 最高学位(学历)证书及认证材料或者相关批准文书、职业资格证明。

5) 无犯罪记录证明及认证材料

6) 体检证明:由中国检验检疫机构出具的境外人员体格检查记录验证证明或健康检查证明书,签发时间均在 6 个月内。

7) 聘用合同或任职证明:应提供中文合同,应由申请人签名并加盖单位公章,不得涂改。

8) 申请人护照或国际旅行证件,护照有效期不得少于 6 个月。

9) 申请人 6 个月内正面免冠照片

10) 随行家属相关证明材料:随行家属包括配偶、 未年 满 18 周岁的子女、父母及配偶父母。

样例:

二、 申请工作签证 (Z Visa)

受理 机构: 中国大使馆

时长: 7个工作日

材料:

1) 有效护照

2) 签证申请表及照片

3) 外国人工作许可通知

样例: 2019年6月1日新版

三、 办理中国境内临时住宿登记 (Registration of Temporary Residence)

受理机构: 住宿地所辖区派出所

时长: 即时办理

外籍人才持工作签证入境中国,须于抵达 后 24小时内, 向住宿地所辖区派出所 申报,填写 《 临时住宿登记表 》 。

四、 申领《中华人民共和国外国人工作许可证》(简称《外国人工作许可证》) (Work Permit)

申请人应当在入境后15日内提出申领《外国人工作许可证》

受理 机构: 外国专家局

时长: 1 0 个工作日

材料:

1) 外国人来华工作许可申请表:入境后在线补充填写《外国人来华工作许可申请表》中有关申领《外国人工作许可证》部分信息。

2) 申请人体检证明:由中国检验检疫机构出具的境外人员体格检查记录验证证明或健康检查证明书,签发时间在 6 个月内。

3) 申请人有效签证或有效居留许可:入境后补充上传护照(或国际旅行证件)签证页、最近的入境签章页或居留许可信息页。

4) 其他材料:许可受理机构或决定机构根据需要要求进行补充提供的材料。

样例:

五、外国人居留许可(工作) (Resid ence Permit )

外籍人才入境中国后须 在 30日内向公安机关出入境管理机构申请办理居留证件。

受理 机构: 公安机关出入境管理机构

时长: 7个工作日

材料:

1) 申请人护照原件,每人一份;

2) 申请人需提交有效的《外国人签证数字相片采集检测回执》,申请人签名,每人一份,原件;

3) 暂住地派出所出具的《境外人员临时住宿登记表》或已与公安机关联网的酒店出具的《境外人员临时住宿登记表》。

4) 如 有随任家属 , 随任家属 须持有所在国家具有法律效力的证明配偶或子女关系、并经过中国驻该国使领馆进行了领事认证的法津文书及翻译文本,原件及复印件。

5) 申请人相片1张(蓝底,规格2寸)用于贴在申请表上,每人一张。

6) 体检证明

7) 《外国人工作许可证》

样例: 2019年6月1日新版

外籍人才在华个税政策整理

根据 2018 年 8 月 31 日第十三届全国人民代表大会常务委员会第五次会议通过的《中华人民共和国个人所得税法》、 2018 年 12 月 22 日公布的《个人所得税法实施条例》及《个人所得税扣缴申报管理办法》, 本文为 你解读 自 2019 年 1 月 起,新税法下外籍员工在工资、薪金中个人所得税政策的变化。

一、 外籍纳税人义务的判定

纳税人身份 | 定义 | 纳税义务范围 |

居民 纳税人 | 在中国境内有住所 无住所而一个纳税年度内在中国境内居住累计满183天的个人 | 境内所得+境外所得 |

非居民纳税人 | 在中国境内无住所又不居住 无住所而一个纳税年度内在中国境内居住累计不满183天的个人。 | 境内所得 |

备注: 税法上所称“住所”是一个特定概念,在境内有住所的个人,是指因户籍、家庭、经济利益关系而在境内习惯性居住的个人。习惯性居住是判定纳税人是居民个人还是非居民个人的一个法律意义上的标准,并不是指实际的居住地或者在某一个特定时期内的居住地。对于因学习、工作、探亲、旅游等原因而在境外居住,在这些原因消除后仍然回到中国境内居住的个人,则中国为该纳税人的习惯性居住地,即该个人属于在中国境内有住所。

对于境外个人仅因学习、工作、探亲、旅游等原因而在中国境内居住,待上述原因消除后该境外个人仍然回到境外居住的,其习惯性居住地不在境内,即使该境外个人在境内购买住房,也不会被认定为境内有住所的个人。

二、 外籍人 才 的“六年法则”

《中华人民共和国个人所得税法实施条例》

第四条 在中国境内无住所的个人,在中国境内居住累计满 1 83 天的年度连续不满六年的,经向主管税务机关备案,其来源于中国境外且由境外单位或者个人支付的所得, 免 缴纳个人所得税 ; 在中国境内居住满 1 83 天的任一年度中有一次离境超过 3 0 天的,其在中国境内居住累计满 1 83 天的年度的连续年限重新计算。

第五条 在中国境内无住所的个人,在一个纳税年度内在中国境内居住累计不超过 9 0 天的,其来源于中国境内的所得,由境外雇主支付并且不由该雇主在中国境内的机构、场所负担的部分,免于缴纳个人所得税。

三、个税起征点

2018 年 8 月 31 日,修改个人所得税法的决定通过,起征点每月 5000 元, 2018 年 10 月 1 日起实施最新起征点和税率。

四、外籍人 才 个税计算——“居民个人”工资薪金性所得

纳税征管方式:

- 累计预扣法

- 扣缴义务人按月预扣预缴

- 纳税人年终汇算清缴

全年应纳税所得额 = 全年收入额 -全年免征额- 全年专项扣除 / 全年外籍人免税补贴 - 全年其他扣除

个人所得税预扣率表一 (居民个人工资、薪金所得预扣预缴适用)

|

另外: 关于外籍个人有关津补贴的政策

( 一 ) 2 019 年 1 月 1 日至 2 021 年 1 2 月 3 1 日期间,外籍个人符合居民个人条件的,可以选择 享受 个人所得税专项附加扣除,也可选择享受住房补贴、语言训练费、子女教育 费等津补贴 免税优惠政策,但不得同时享受。外籍个人一经选择,在一个纳税年度内不得变更。

( 二 ) 自 2 022 年 1 月 1 日起,外籍个人不再享受住房补贴、语言训练费、子女教育费津补贴免税优惠政策,应按规定享受专项附加扣除。

五、 外籍人 才 个税计算——“非居民个人”工资薪金性所得

非居民个人综合所得沿用分类分项、按月 按次 代扣代缴方式,不办理年终汇算清缴。

工资薪金月度应纳税所得额 = 月度实际收入额 -个税免征额

个人所得税税率表二 (非居民个人工资、薪金所得,劳务报酬所得,稿酬所得适用)

|

六、 全年一次性奖金个税筹划

(一) 居民个人取得全年一次性奖金, 在 2 021 年 1 2 月 3 1 日前, 不 并入当年综合所得 ,以全年收入除以 1 2 个月得到的数额,按照所附按月换算后的综合所得税率表(简称月度税率表),确定适用税率和速算扣除数,单独纳税。

(二) 计算公式:应纳税额 = 全年一次性奖金收入 * 适用税率 - 速算扣除数

(三) 自 2 022 年 1 月 1 日起, 居 民个人取得全年一次性奖金,应并入当年综合所得计算缴纳个人所得税 。

个人所得税税率表三 (非居民个人工资、薪金所得,劳务报酬所得,稿酬所得适用)

|

例子:

小张 2 018 年入职,于 2 019 年 全年从 雇主处取得薪金所得的应纳税所得额为人民币 15 0 , 000 元(已扣除 所有可扣除项)。 2 019 年 1 2 月取得全年一次性奖金 5 0 000 元。 下表将全年一次性奖金 不 并入当年综合所得和并入当年综合所得产生的应 纳税额做比较 :

选择方式 | 综合所得应纳税额 | 全年一次性奖金应纳税额 | 全年应纳税额 |

方式1: 全年一次性奖金 不 并入当年综合所得 | 1 50,000 * 20% - 16,920 = 13080 | 5 0,000 * 10% - 210 = 4,790 | 1 7,870 |

方式2: 当年一次性奖金并当年综合所得 | ( 150,000 + 50,000) * 20% - 16920 = 23,080 | 2 3 , 080 | |

差异 | 方式1-方式2 | - 5210 | |

结论: 不 并入综合所得更省税

外籍人才 在华工作, 工作 许可 证 的变更、延期问题

本文就 外籍人才在中国境内工作, 或者发生岗位变动后, 工作许可证 的变更、延期分情况做出详解。

情况一、 外国人变换了公司但工作岗位(职业)未变动,且工作类居留许可仍在有效期内 , 可以转移外国人工作许可证而不用重新办理。

流程概述:

Step 1 : 注销现有工作许可证

提前终止合同、解除聘用关系的,用人单位应当于事项发生之日起10个工作日内向决定机构申请注销。用人单位被终止的,申请人可以向决定机构 申请注销工作许可。

注销需要的资料如下:

1) 外国人来华工作许可注销申请表

2) 聘用关系解除、合同终止或其他与注销原因相关的证明材料

Step 2 : 办理转聘

注销原工作许可后,自注销之日起30日内提交新工作许可申请:

转聘 需要的资料如下:

1) 外国人来华工作许可申请表

2) 聘用合同

3) 有效居留许可、护照信息页

4) 注销证明

其他如学历、无犯罪认证、体检等则不需要重新提交。

情况二、 不在居留许可有效期内或 工作岗位(职业)发生变动 , 应重新申请办理外国人来华工作许可。

情况三、 申请《外国人工作许可证》延期

用人单位在原岗位(职业)继续聘用申请人的 ,应当在申请人的来华工作许可有效期届满30日前向决定机构提出申请。

需要资料如下:

1) 外国人来华工作许可延期申请表

2) 聘用合同或任职证明

3) 护照、签证或有效居留许可

4) 《外国人工作许可证》

情况四、 申请《外国人工作许可证》信息变更

申请人个人信息(姓名、护照号、职务、类别)等事项发生变更的 ,应当自变更事项发生之日起10个工作日内向许可决定机构提出申请。

同一单位改任新职务的,包括从专业岗位提升至行政管理岗位,应提供变更申请函(说明变更原因、新任职务等,用人单位盖章)及相应的证明材料,

1) 外国人来华工作许可变更申请表

2) 申请变更事项的证明文件

外籍员工 在华工作 社 保 及公积金 问题

一、 外籍人员上社保是强制的吗?

2011年9月6日,中华人民共和国人力资源和社会保障部正式颁布了《在中国境内就业的外国人参加社会保险暂行办法》,明确要求自2011年10月15日起所有在华就业的外籍人员需参加社会保险。

用人单位招用外国人的,应当自办理就业证件之日起 30 日内为其办理社会保险登记。 受境外雇主派遣到境内工作单位工作的外国人,应当由境内工作单位按照前款规定为其办理社会保险登记。

二、 外籍员工参保的险种有哪些?

外国人在中国参加社会保险应当等同于中国公民,均应参与“养老、医疗、工伤、生育、失业”五个险种。

三 、哪种情况外籍员工可免缴社保 ?

具有与我国签订社会保险缴费双边或多边协议国家国籍的就业人员, 在其依法获得在我国境内就业证 3 个月内提供协议国出具 参保证明 的,应按协议规定免除其规定险种在规定期限内的缴费义务。

截止到2 019 年, 我国已与12个国家签署了双边社会保障协定。其中,与德国、韩国、丹麦、加拿大、芬兰、瑞士、荷兰、西班牙、卢森堡、日本10国签署的社会保障协定已经生效实施。

国家 | 签署日期 | 生效日期 | 主要免除项目 |

中国-德国 | 2 001 / 7 / 2 2 002 / 2/18 | 2 002 / 4 / 4 | 养老保险、失业保险 |

中国-韩国 | 2 012/10/29 2 012/12/26 | 2 013 / 1 / 16 | 中国为养老保险,韩国为国民年金、雇佣保险等 。 |

中国-丹麦 | 2 013/12/9 | 2 014 / 5 / 14 | 中国为职工养老保险;丹麦为社会养老、ATP 。 |

中国-芬兰 | 2 014/9/22 2 016/10/18 | 2 017 / 2 / 1 | 中国为职工基本养老保险和失业保险;芬兰为与收入相关的年金计划下的老年、残疾和遗属年金及失业保险。 |

中国-加拿大 | 2 015/4/3 | 2 017 / 1 / 1 | 中国为职工基本养老保险、城乡居民基本养老保险;加拿大为老年保障法案及据此制定的法规、加拿大养老金计划及据此制定的法规。 |

中国-瑞士 | 2 015/9/30 | 2 017 / 6 / 19 | 中国为职工基本养老保险、城乡居民基本养老保险、失业保险;瑞士为养老和遗属保险、残疾保险。 |

中国-荷兰 | 2 016/9/12 | 2 017 / 9 / 1 | 中国为职工基本养老保险、失业保险;荷兰为养老保险、失业保险和遗属保险。 |

中国-法国 | 2 016/10/31 | ||

中国-西班牙 | 2 017/5/19 | 2 018/3/20 | 中国为职工基本养老保险、失业保险;西班牙为社会保障制度中适用于雇员的缴费型养老金,其中不包含工伤和职业病保险;雇员的失业保险缴费与待遇。 |

中国-卢森堡 | 2 017/11/27 | 2 019 / 5 / 1 | 中国 为 职工基本养老保险 卢森堡 为 涉及养老、病残和遗属的养老保险 。 |

中国-日本 | 2 018/5/9 | 2 019 / 9/1 | 中国为职工基本养老保险,日本为国民年金(国民年金基金除外)和厚生年金(厚生年金基金除外) |

中国-塞尔维亚 | 2 018/6/7 |

办事指南 : http://si.12333.gov.cn/147509.jhtml

四、 外籍人才离境社保账户问题

其社会保险个人账户予以保留,再次来中国就业的,缴费年限累计计算;经本人书面申请终止社会保险关系的,也可以将其养老保险个人账户储存额一次性支付给本人;外国人死亡的,其养老保险个人账户余额可以依法继承。

五、 单位必须为与其建立劳动(聘用)关系的外籍、获得境外永久(长期)居留权和台、港、澳来沪工作人员缴交住房公积金吗?

外籍、获得境外永久(长期)居留权和台、港、澳在沪工作人员经与单位协商一致的可以在本市缴存住房公积金。